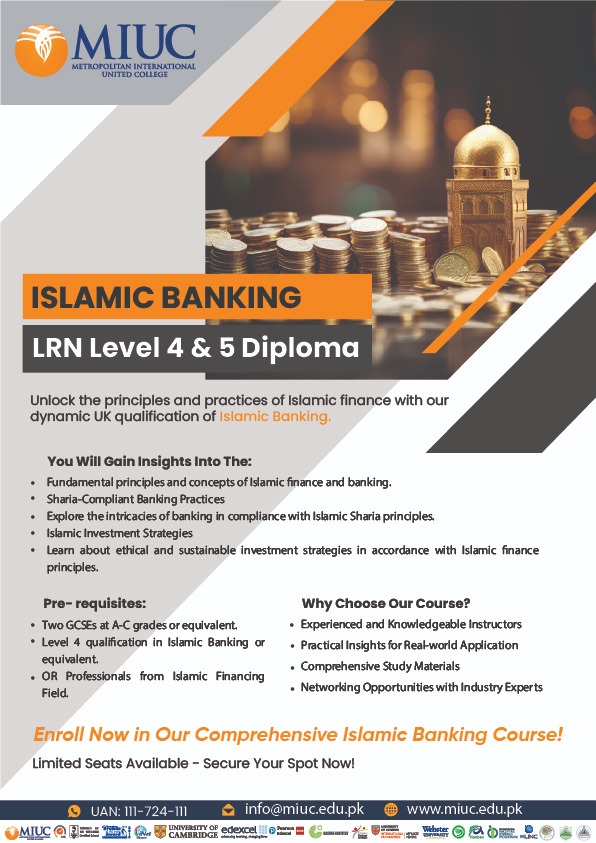

Unlock the principles and practices of Islamic finance with our dynamic course designed to provide a deep understanding of Islamic Banking.

Certification in Islamic Banking (LRN)

Affiliated With :

Learning Resource Network

Duration:

1 month + 2 month

Guided Learning:

840 Hours + 177 Hours

Mode of Study:

Full Time

Level :

4 & 5

Credits:

15 + 30

Programme Details

How you'll Study

LRN level 4 and 5 Certification in Islamic Banking

Welcome to Metropolitan International United College, your gateway to excellence in Islamic Banking education. Our comprehensive qualification in Islamic Banking is meticulously crafted to provide students with a deep understanding of the principles and practices of Islamic finance. With a focus on Sharia-compliant banking practices, ethical investment strategies, and a diverse range of Islamic financial products, our program equips learners with the knowledge and skills needed to thrive in the dynamic world of Islamic banking. Taught by experienced instructors and supported by comprehensive study materials, our qualification offers practical insights for real-world application. Whether you’re looking to advance your career or deepen your understanding of Islamic finance, Metropolitan International United College is your trusted partner on this educational journey. Enroll today and unlock the doors to a successful future in Islamic banking

Programme Details

- Introduction to Islamic Financial instruments Gain insights into the fundamental principles and concepts of Islamic finance and banking.

- Sharia-Compliant Banking Practices: Explore the intricacies of banking in compliance with Islamic Sharia principles.

- Islamic Investment Strategies: Learn about ethical and sustainable investment strategies in accordance with Islamic finance principles.

- Understand the concepts of Sukuk: Examining how to structure Sukuk using different financial instruments

- Islamic Financial Products and Services: Explore a variety of Islamic financial products, including Mudarabah, Ijarah and Sukuk.

Target Market

- Financial Skills Partnership (FSP)

- The Office of Qualifications and Examinations Regulation (OFQUAL)

- Malta Qualifications Recognition Information Centre (MQRIC)

Eligibility Criteria

- Candidates should have: Two GCE (A to C grade, or equivalent) qualifications

- Advanced GNVQ with a specific grade or equivalent;

- Level 4 qualification (or equivalent - HNC) in Islamic Banking

Candidates should also have a speaking, listening, reading and writing ability which is commensurate to CEFR Level B1 (or equivalent). This to ensure they meet the communication requirements for this qualification. Candidates should be familiar with the Islamic banking sector or at least have an interest in furthering their career within this sector.